Critical Situation

US Self-Sufficient Lithium-Battery Ecosystem

The Vital Role of Lithium Batteries: Powering the Future

Lithium batteries are the backbone of modern technology, powering everything from personal electronics to critical national security systems. They are also pivotal in the global shift toward electric vehicles (EVs) and clean energy storage solutions. Despite significant advancements in research, the United States faces a critical challenge—a lack of a robust supply chain to meet the rapidly growing demand.

To address this shortfall, a national initiative is underway to develop a self-sustaining lithium battery supply chain. This effort focuses on overcoming scientific and manufacturing challenges, particularly in the EV and energy grid sectors. By advancing battery technologies and encouraging strategic investment, the U.S. aims to secure its position as a global leader in battery production.

The benefits extend far beyond manufacturing. Expanding the lithium battery industry will create high-quality jobs, strengthen energy independence, and contribute to combating climate change. The rising demand for lithium batteries highlights the interconnectedness of technology, economic growth, and environmental sustainability. To secure a prosperous and sustainable future, it is crucial to balance this demand with energy security and responsible environmental stewardship.

Global Battery Manufacturing

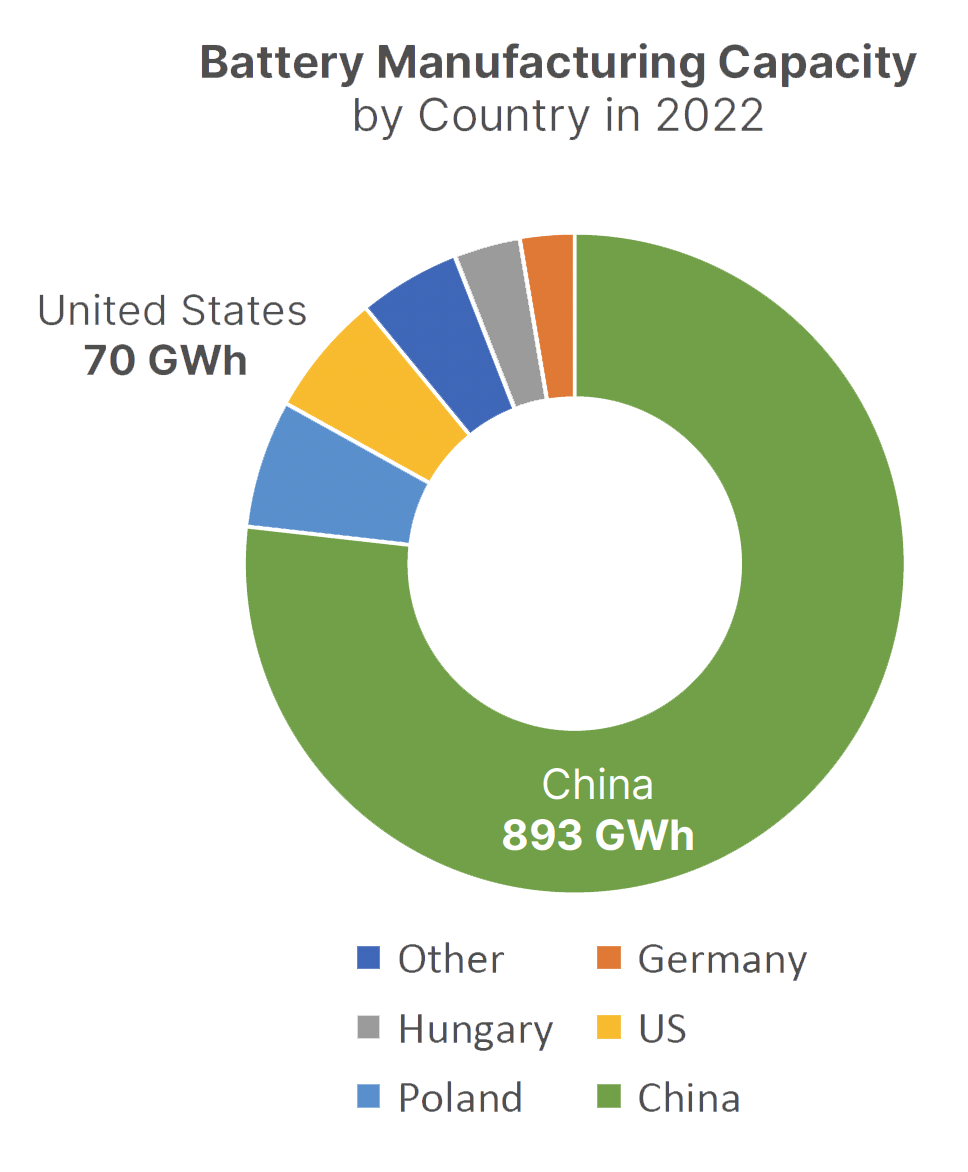

US: 6% of global battery production (70 GWh)

Strengthening U.S. Battery Production: A Strategic Shift

Global battery manufacturing is currently dominated by China, South Korea, and Japan, with China alone accounting for an overwhelming 893 GWh of global capacity. This dominance is a result of China's early prioritization and substantial investment in battery manufacturing infrastructure. In contrast, the United States holds just 6% of the global battery production capacity, producing 70 GWh.

To close this gap, the U.S. is leveraging the Advanced Manufacturing Production Credit (45X), which offers incentives of up to $45 per kWh of battery capacity, aimed at bolstering the downstream EV battery supply chain. This initiative is part of a broader strategy to reduce reliance on foreign suppliers, particularly from China, and ensure greater energy security and supply chain resilience.

By diversifying and localizing supply chains, automakers in the U.S. will not only be better equipped to handle global disruptions but also meet growing domestic and international demand. Furthermore, these efforts align with ambitious climate goals and address human rights and environmental concerns associated with overseas mining practices.

With increasing domestic investments and a focus on strengthening local supply chains, North America is on track to become the second-largest player in global battery production. These advancements mark a pivotal step toward achieving energy independence, fostering economic growth, and securing a more sustainable future.

North American Battery Manufacturing Supply Chain Opportunity

US Self-Sufficient Lithium-Battery Ecosystem

Strengthening the U.S. EV Supply Chain: A Path to Economic Growth

A robust domestic supply chain for EVs and batteries not only creates well-paying jobs across industries like mining, engineering, and manufacturing but also fosters healthier, more resilient economies. Federal legislation such as the Inflation Reduction Act and the Infrastructure Investments and Jobs Act has been pivotal in accelerating this transformation. Together, these laws allocate at least $83 billion in loans, grants, and tax credits to support the production of low- and zero-emission vehicles, batteries, and charging infrastructure, according to Atlas Public Policy (APP).

Looking ahead, RMI estimates that if the U.S. deploys EVs at a pace aligned with net-zero targets, federal spending could surpass $200 billion, as key tax credits have no cap on expenditure.

In response to these investments, automakers are ramping up their commitments to EV production. Ford, General Motors, Tesla, and Stellantis lead the charge, with U.S.-based companies announcing over $173 billion in investments for the transition to EVs. These actions demonstrate a growing confidence in government support and rising consumer demand.

Key Figures at a Glance:

- $83B: Funding through the Inflation Reduction Act and federal loans.

- $200B+: Potential spending through uncapped federal tax credits for EV production.

- $173B: Investments committed by leading automakers to EV manufacturing.

The convergence of federal policies and private sector investments is paving the way for a sustainable, self-reliant energy future while fueling economic prosperity and job creation

Transforming Energy Storage:

Key Developments in the U.S. and EU LFP Battery Markets

A Chronological Journey of Innovation, Investment, and Market Expansion

January 2025

U.S. Reduces Reliance on Chinese LFP Imports

Policies to diversify supply chains and promote domestic production lead to a surge in U.S.-based investments, with automakers and suppliers aligning efforts to meet sustainability and energy independence goals.

25/12/2024

North America Poised to Become Second-Largest Battery Market

Reports highlight North America’s rapid growth in battery manufacturing, fueled by localized supply chain investments and increasing demand for LFP batteries in EVs and grid storage applications.

01/08/2023

U.S. Introduces Advanced Manufacturing Production Credit (45X)

The U.S. government implements the 45X Production Credit, offering up to $45 per kWh of battery capacity to incentivize domestic manufacturing, aiming to boost the U.S. share of global battery production from 6%

21/03/2021

EU Announces Battery Strategy

The European Union unveils its "European Battery Alliance" initiative to strengthen its battery production capacity and reduce reliance on imports, setting ambitious goals for domestic manufacturing by 2030.

13/06/2019

China Leads Global Battery Manufacturing

China secures its dominance in global battery production, accounting for over 70% of the market, with early prioritization of Lithium Iron Phosphate (LFP) technology and significant government investments