LFP (Lithium Iron Phosphate) Market Overview

The Global Shift in Lithium Iron Phosphate (LFP) Battery Production

For years, China has dominated LFP battery production, serving as the central hub for LFP battery chemistry. This dominance stemmed from several factors, most notably key LFP patents held by a research consortium. Under an exclusive agreement, Chinese battery manufacturers were exempt from license fees, allowing them to produce LFP batteries without additional costs—but only within China.

As of 2022, these patents have expired, eliminating licensing barriers and making overseas production more viable than ever. Additionally, China’s early adoption of government subsidies for LFP supply chains further cemented its leadership in the market.

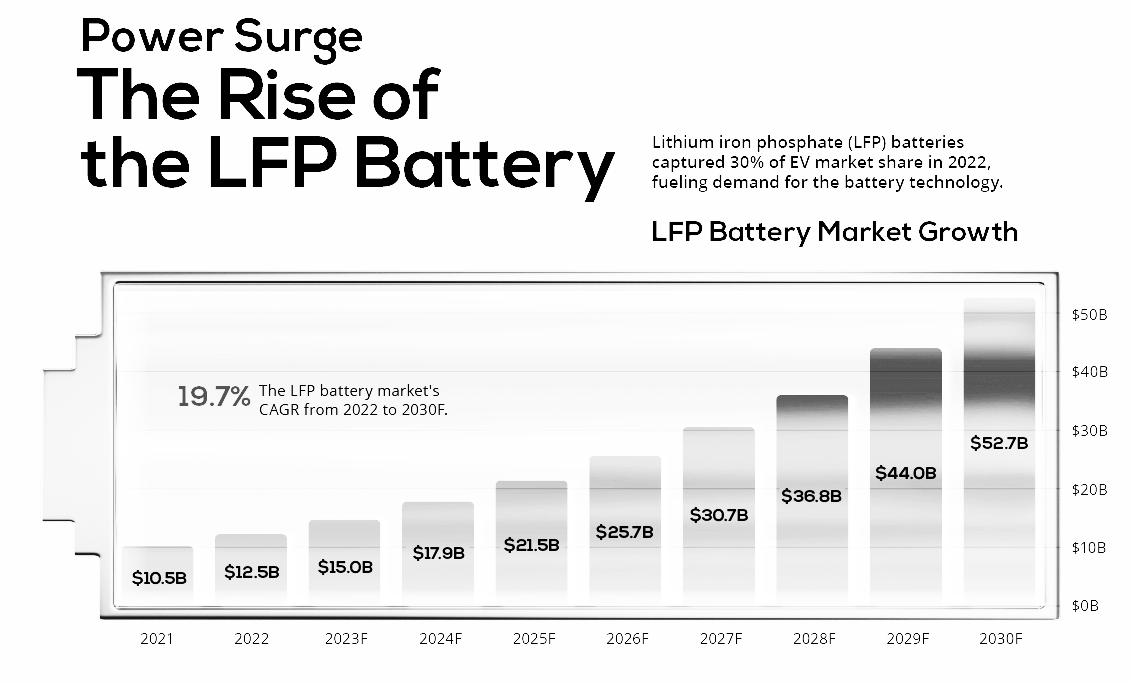

Now, the landscape is rapidly changing. Major EV manufacturers outside China, including Tesla and Volkswagen, have begun integrating LFP battery chemistry into their high-volume, entry-level EV models. Notably, nearly half of Tesla’s EVs produced in Q1 2022 were equipped with LFP batteries.

With demand surging, plans for LFP battery production facilities in the U.S. and Europe are already in motion. This marks a pivotal shift in the global battery industry, as companies look to diversify supply chains and localize production to meet the needs of expanding EV markets.

The Global Shift in LFP Battery Production

From China to a Diversified Future

How Expired Patents, EV Demand, and Government Policies Are

Reshaping the LFP Battery Industry in the U.S. and Europe

LFP Battery Production Has Been Centered in China

For years, China has dominated global LFP battery production, primarily due to strategic industry policies and intellectual property agreements. The country established itself as the leader in LFP chemistry by fostering large-scale manufacturing and supply chain development. China’s stronghold on the market was further reinforced by local agreements that allowed domestic manufacturers to produce LFP batteries without paying licensing fees, making production significantly more cost-effective than in other regions.

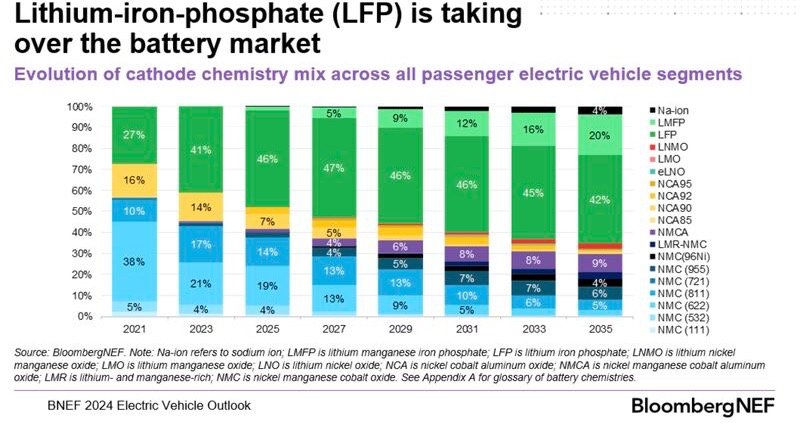

Tesla and Volkswagen Are Integrating LFP Batteries Into Their EV Models

Major EV manufacturers like Tesla and Volkswagen are shifting toward LFP battery technology for entry-level, high-volume EV models. LFP batteries offer key advantages, such as longer cycle life, enhanced safety, and lower costs compared to traditional lithium-ion batteries with nickel and cobalt. Notably, in Q1 2022, nearly half of Tesla's EVs were equipped with LFP batteries, signaling a major industry shift. This transition is expected to drive LFP battery demand even further, accelerating production expansion outside of China.

Due to Expired Patents and Growing Demand, Production Is Expanding to Europe and the United States

LFP battery patents expired in 2022, removing previous restrictions that limited production outside of China. This change has opened new opportunities for battery manufacturers in Europe and the U.S., where demand for LFP batteries is rapidly increasing. With government incentives, private investments, and the growing electric vehicle (EV) market, companies are now setting up new LFP battery production facilities in Western markets, aiming to reduce dependency on Chinese supply chains and strengthen domestic energy security.

China Had an Early Advantage With LFP Subsidies in Its Supply Chain

One of the key reasons behind China’s dominance in LFP battery production is early and extensive government subsidies. The Chinese government strategically supported the development of LFP battery materials, manufacturing plants, and supply chains, making production significantly cheaper. These subsidies allowed Chinese manufacturers to scale up rapidly and outcompete international firms, creating an economy of scale that gave them a long-term cost advantage. However, with increased investments in U.S. and European battery manufacturing, Western markets are now working to close the gap and localize supply chains.

This global shift in LFP battery production is expected to reduce reliance on China, enhance energy security, and support the growing EV market worldwide.